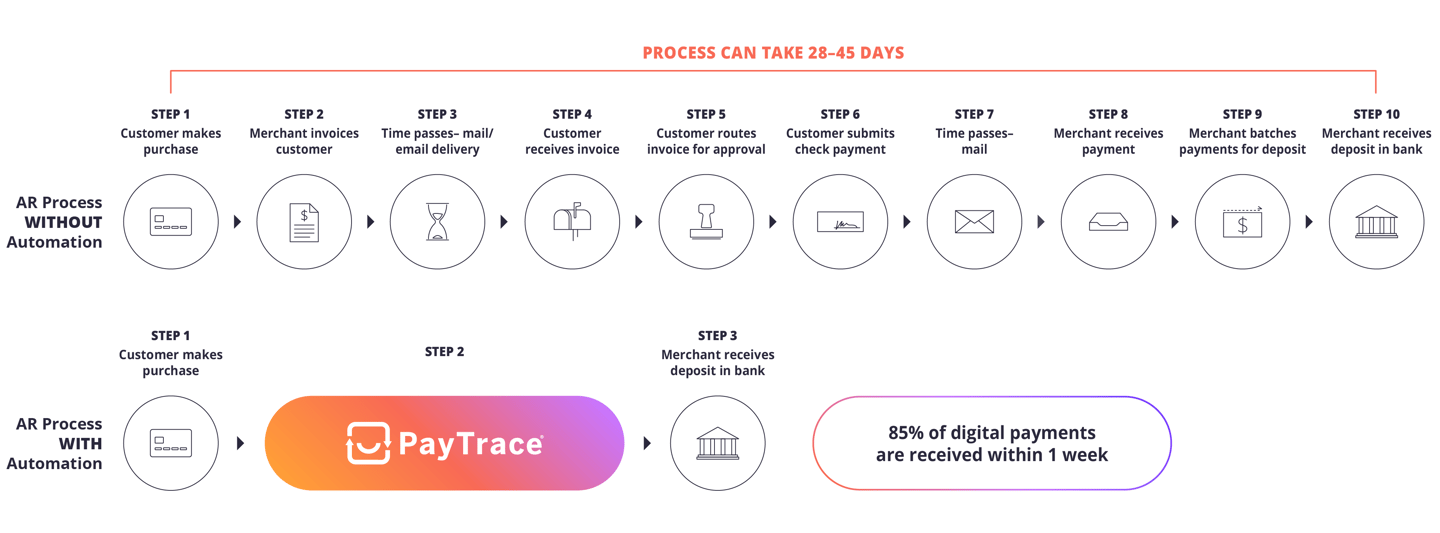

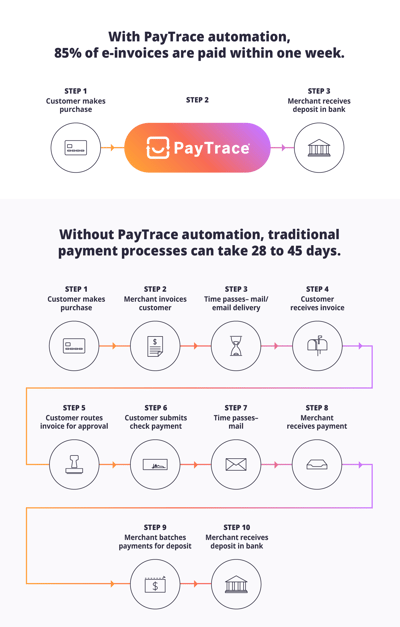

Save time and money with accounts receivable automation

Digitizing your invoicing process makes it easier for your clients to pay, and for you to get paid. By adding credit card payments to an e-invoice, you can eliminate manual work, cut costs, and reduce your time to getting paid from 28 days to 1.

Seamless connections with your back-office financial systems

Trace AR™ easily connects to your accounting and ERP systems to provide AR automation and simple reconciliation in a central hub to manage your accounting processes.

Learn more: ACUMATICA > BUSINESS CENTRAL > NETSUITE > QUICKBOOKS >

Create a B2B invoice payment link with Trace AR

Sending a digital payment link speeds up both invoice delivery and payment. You can expect faster “invoice to cash” while eliminating manual processes and lowering resource costs. Credit card payments also offer the benefit of lower fraud rates than payments made with paper checks and wire transfers.

Your customers benefit from automation

Your clients can pay using the payment method they want on your customized web payment form or through their dedicated client portal. E-invoicing improves customer satisfaction by making their payments easier to submit and track.

What can you do with automation from Trace AR?

-

Send “click-to-pay” payment links to your customers via email and text message.

-

Apply discounts, sales tax, and fees (including credit card surcharges, cash discounts, and late fees).

-

Customize invoices with your logo and brand colors.

-

Send payment reminders for outstanding invoices.

-

Create itemized invoices and schedule payments in one simple step.

-

Set up recurring or installment payments that include automatic payment alerts.

-

Reconcile payments to their respective invoices.

-

Track invoice history, from creation to paid, for all customers.

Reduce days sales outstanding (DSO) from 28 days to 1

Seven benefits of AR automation

-

Saves a Ton of Time

Spend less time managing accounts receivables.

-

Saves Effort

Radically improve back-office efficiencies & reduce errors.

-

Saves Money

Increase productivity, reduce DSO and B2B card transaction fees.

-

Increases Visibility

Get instant, real-time insights into the payments process.

-

Improves CX

Effortless experiences, multiple ways to pay, with a digital audit trail.

-

Faster Payments

Fewer past-due invoices & more on-time payments.

-

Accelerates Cash Flow

Increase business flexibility and growth options.

Compare PayTrace invoicing products

|

|

|

| Invoicing | ||

|---|---|---|

| Attach invoices |

|

|

| Email payment link |

|

|

| Recurring/ subscription billing |

|

|

| Create custom invoices |

|

|

| SMS & QR code payment link |

|

|

| Enhanced reporting & reminders |

|

|

| Client portal |

|

|

| Payments | ||

| Accept cards & ACH |

|

|

| Add surcharge |

|

|

| Tax calculation |

|

|

| Integrations | ||

| Acumatica |

|

|

| Microsoft Dynamics 365 Business Central |

|

|

| QuickBooks Online |

|

More ways to accept payments

-

RECURRING payments

Create subscription payments that automate installments.

-

payment vault

Store sensitive client data for return clients to use.

-

virtual terminal

Key in phone or other manual transactions through a web browser.

-

hosted payments

Accept payments securely through PayTrace's hosted form to reduce your PCI scope.

-

simple api

Add payment features or connect with other software systems quickly and easily.

-

payment buttons

Add Buy Buttons to your website for a simple customer checkout solution.