B2B payment services fuel

your business.

automation solutions that save you time, effort, and money.

Boost Merchant Cash Flow with

Digital B2B Payments

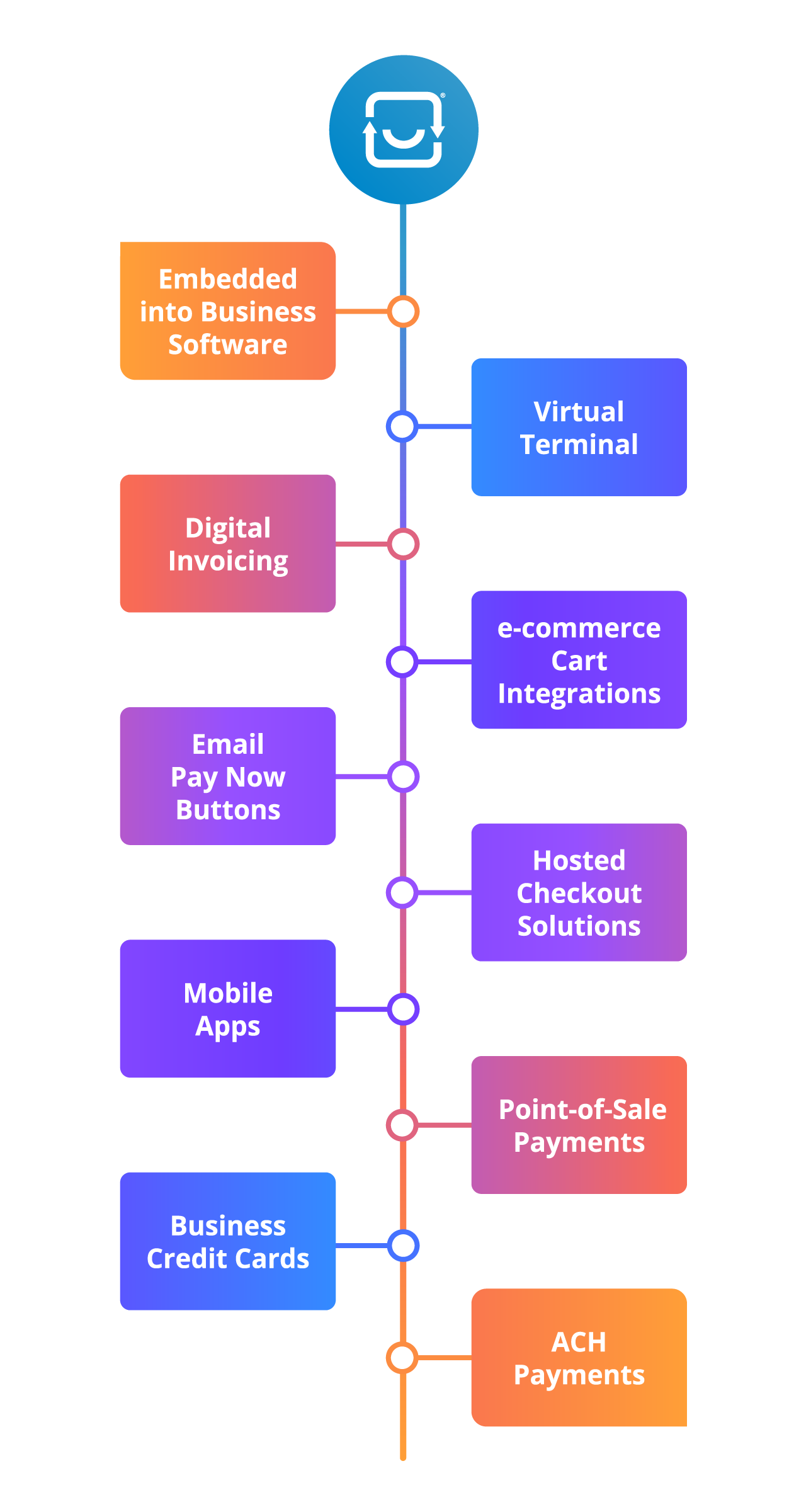

Accept business payments anywhere – enabling small business

and government customers to pay the way they want.

Instantly improve the B2B payment experience.

Give your customers more payment options by automating B2B and B2G payment workflows and accepting purchasing cards and ACH payments.

How merchants benefit from PayTrace B2B payment solutions.

By accepting cards and e-invoicing your business clients, you’ll move away from paper checks and wire transfers and toward a more streamlined, automated, and predictable cash flow. Also, you’ll reduce merchant processing costs on B2B transactions with interchange optimization.

Collecting payments 24/7 has never been easier.

Our automated B2B and B2G payment solutions speed up access to payments and improve cash flow.

As your payment gateway and B2B/B2G payment processing platform, PayTrace delivers secure cloud-based payment acceptance and integrated solutions to save you time, effort, and money.

PayTrace increases your EFFICIENCY by integrating with core business systems.

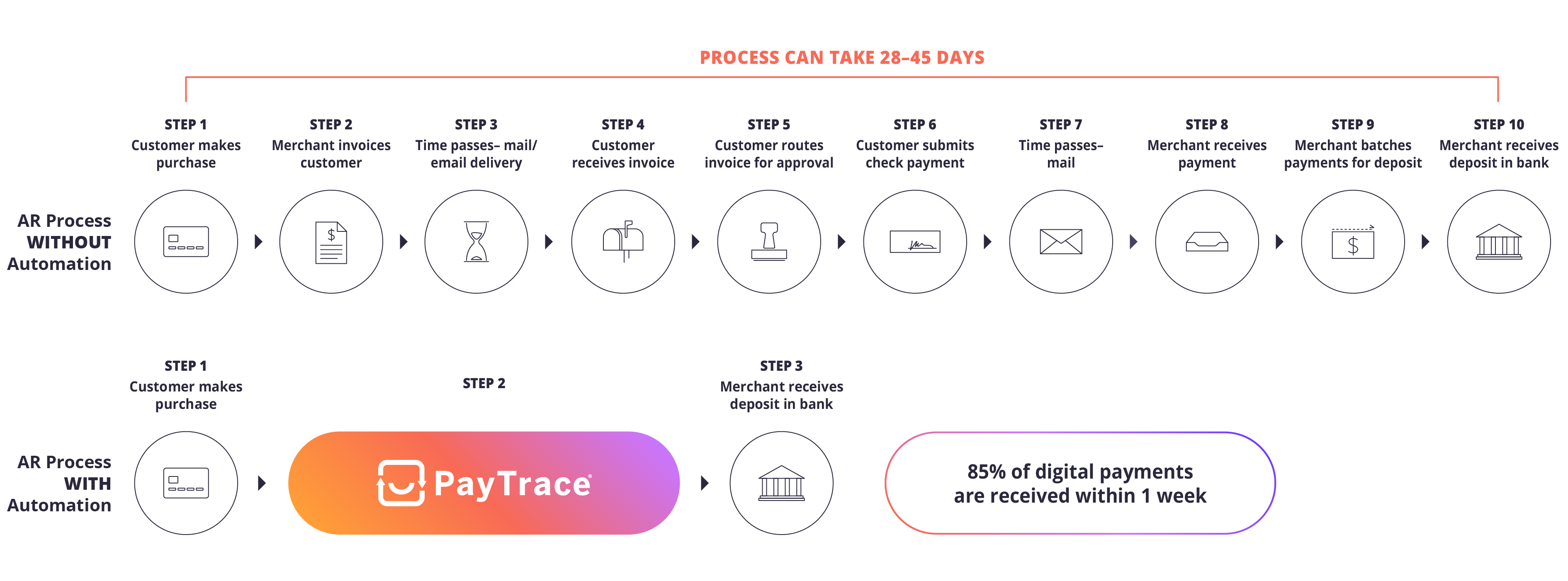

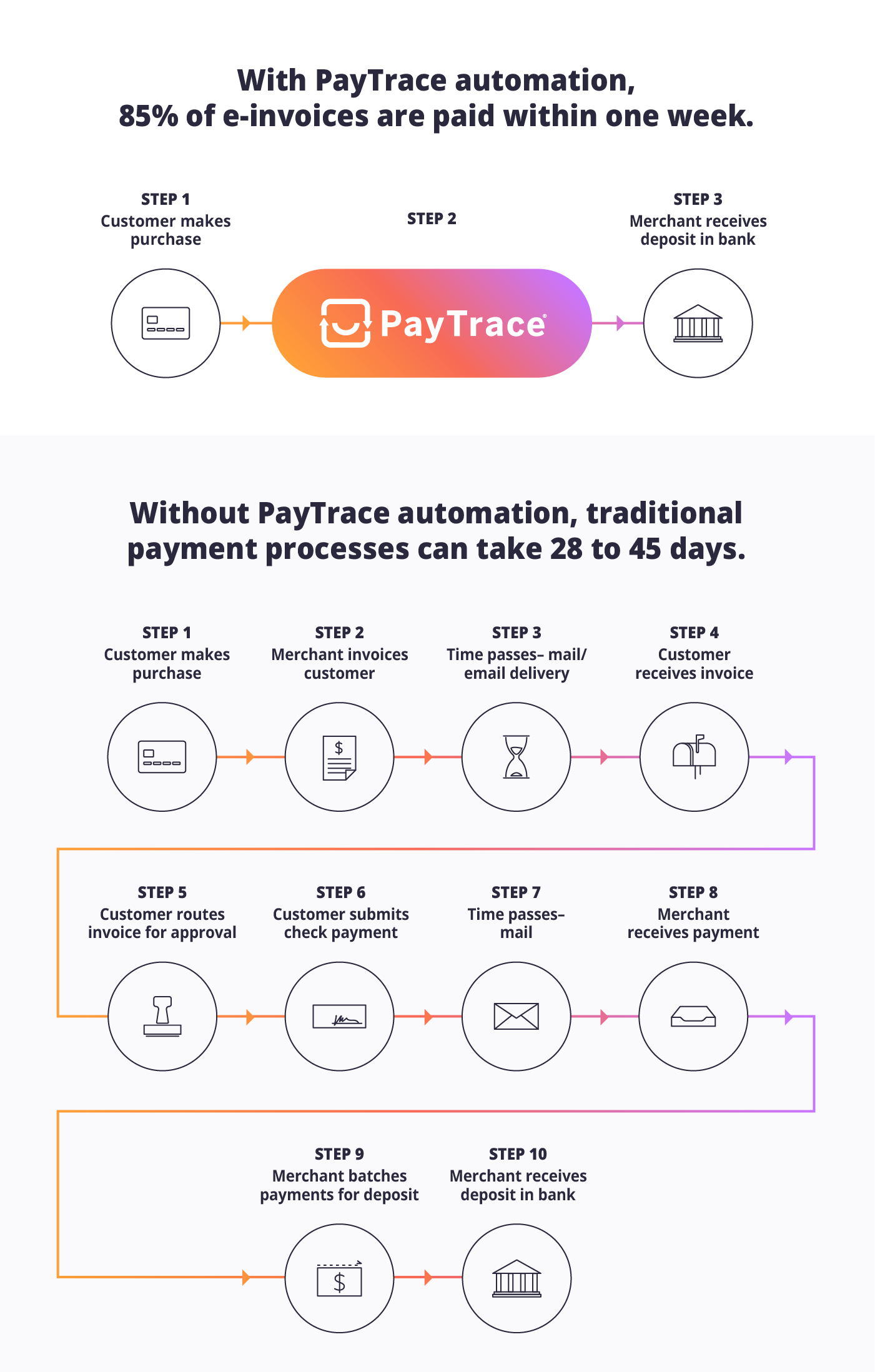

Inefficient manual processes tie up resources and increase the risk of human error. PayTrace advanced payment automation solutions streamline back-office processes, eliminate manual steps, and get you paid sooner.

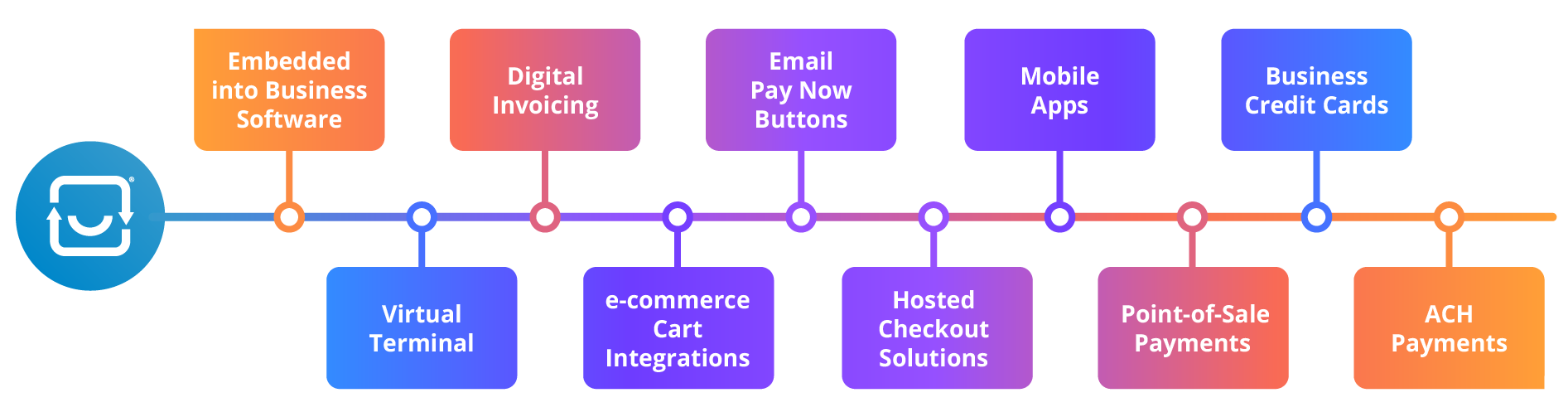

PayTrace B2B payment processing integrates easily with existing business software, including:

Choose from invoicing software products for ERP, CRM, e-commerce, point of sale, and accounting systems with built-in PayTrace payment processing.

Get an advanced, automated accounts receivable payments solution ready to plug into your AR workflow with no need for in-house development.

Reduce DSO from 28 days to 1.

PayTrace automated payment workflows eliminate manual processes, improve customer experiences, and accelerate your access to capital.