Understanding the new Visa Commercial Enhanced Data Program (CEDP)

CEDP explained

Visa has announced its new Commercial Enhanced Data Program, which aims to improve the overall quality of...

Three BIG benefits of streamlining and automating your AR process include saved time, reduced errors, and slashed costs. Let’s examine those three and continue to explore more benefits of an automated accounts receivable system that will impact your employees, your bottom line, and your ability to grow.

Did you know that when you accept business credit cards online, you can also streamline payment workflow using electronic invoicing and send one-click Pay Now links for all your business customers? Imagine the time saved – for you and your buyers. When you choose to digitize and automate all outgoing invoices, you are providing business customers with desirable self-service options that make it easy for them to pay their B2B bills online, via a mobile device, or even over the phone.

You save business clients a ton of time paying and keeping track of their bills, while freeing up your own AR team’s schedule to take on new tasks and responsibilities.

An electronic invoicing system is the answer you’ve been needing to streamline your accounts receivable management services. By accepting corporate credit cards, ACH payments, and corporate purchasing cards, accounts receivable management gets easier. Accounts receivable accounting workflows are streamlined for both you and your customers. Electronic invoicing software helps your team spend less time managing accounts receivable and provides customers flexible payment choices.

Your customers will thank you for the convenience, save steps and time on their end, and end up paying their bills more consistently – making your accounts receivable cash flow more predictable and fluid.

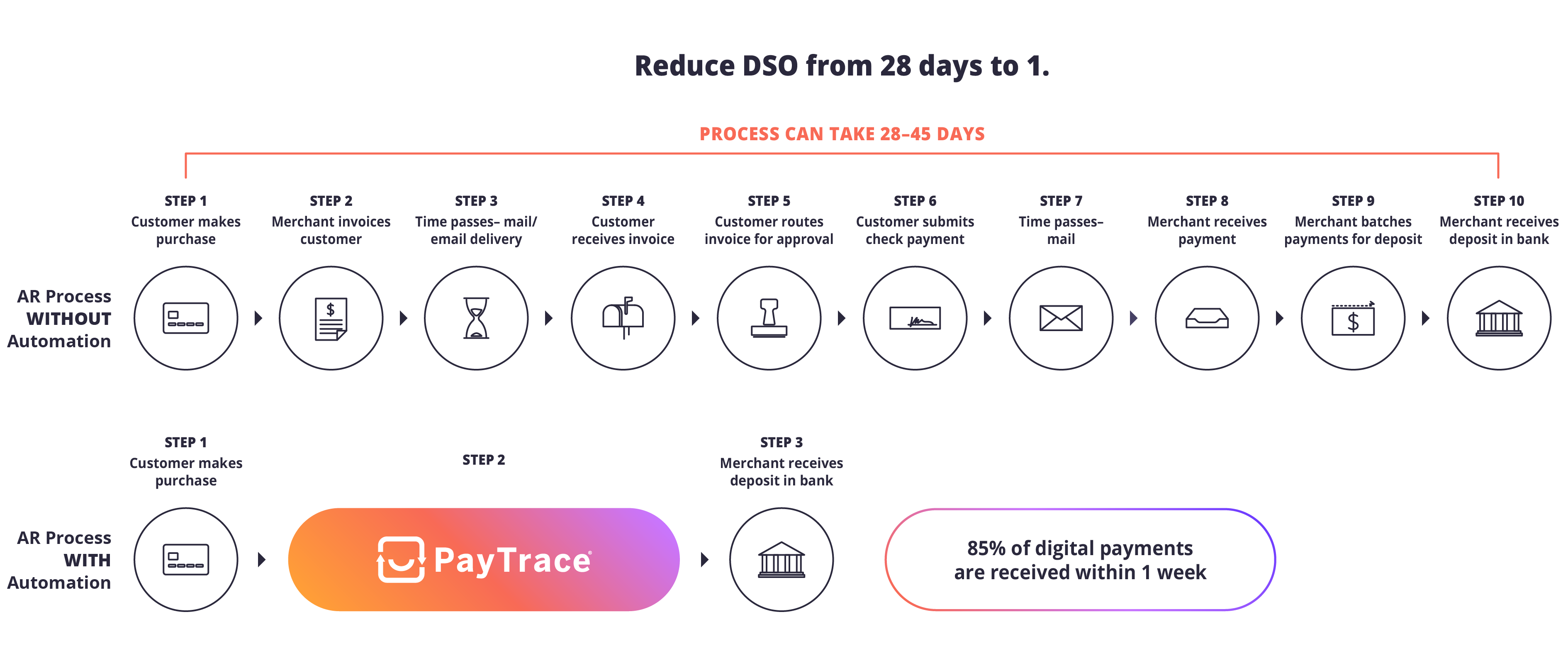

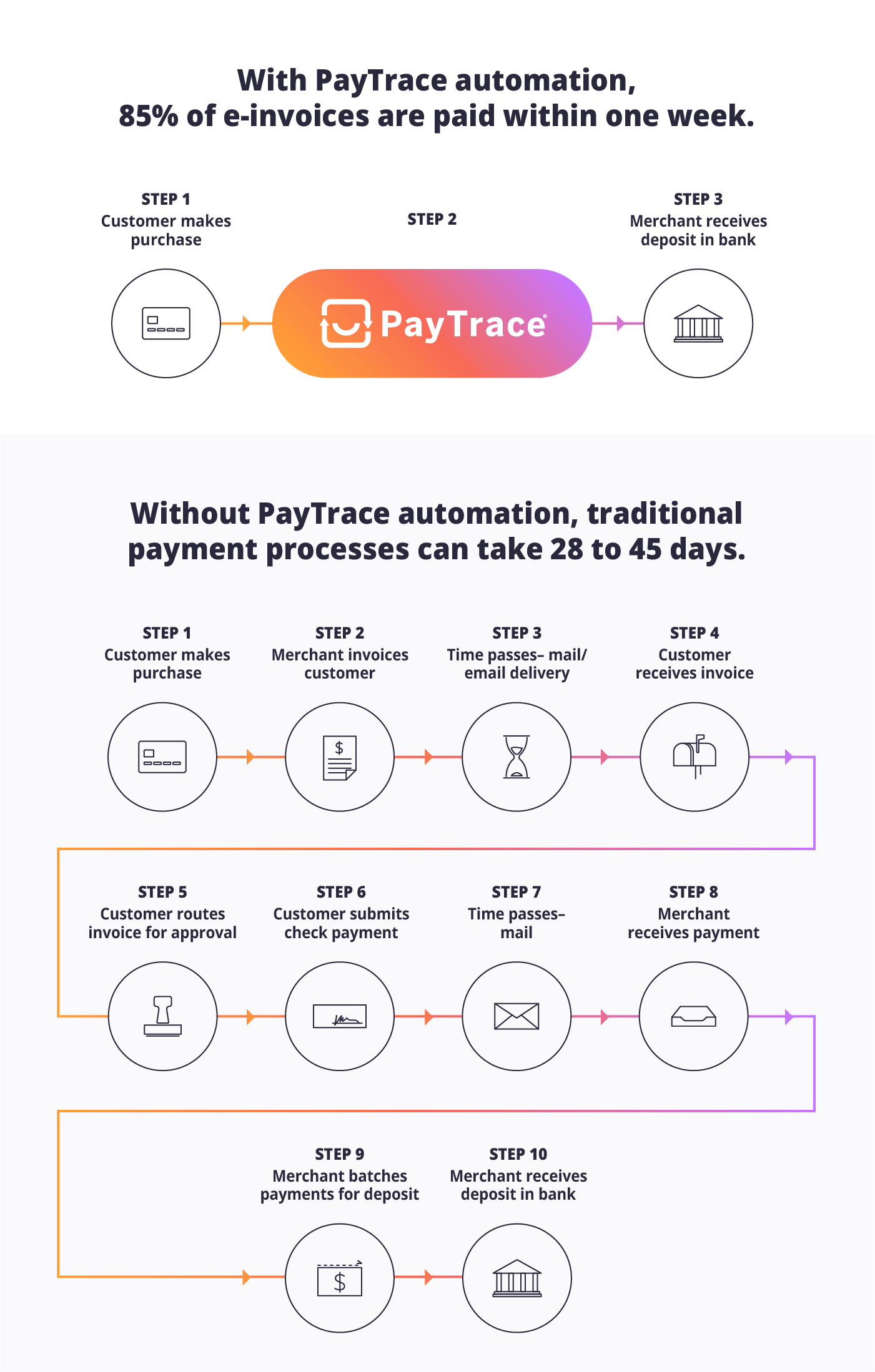

In the illustration below, it’s very clear how PayTrace accounts receivable automation software saves you steps. No more mailing invoices and depositing checks. That’s because our automated payment system simplifies workflow by combining a payment gateway, risk management, e-invoicing, processing, and an acquirer, an integral part of the payment processing flow that’s responsible for settling card transactions, into one, centralized solution that easily integrates with your existing technology.

Accelerate cash flow with PayTrace’s automated payment solutions, digital B2B e-invoicing, streamlined workflows, and B2B payment experts.

Inefficient manual processes tie up accounts receivable resources and increase the risk of human error. It’s hard to deny that fewer errors and more efficiency come naturally when you enter the liberating territory of streamlined workflows brought about by AR automation. After all, robots make fewer mistakes and work longer hours – with no complaints. PayTrace’s AR automation streamlines your receivables processes, increases efficiencies, and reduces time to payment, with 75% of digital payments received within one hour.

Another way that AR automation reduces workload and manual effort is by reviewing all your customers’ transactions, optimizing data fields for you, and qualifying them for credit card payment fee savings on all PayTrace products, all day, every day – around the clock. The PayTrace system automates the process of pulling the additional data needed to qualify merchants for interchange optimization, which means no extra work is required on the part of your team. One of our PayTrace payment automation experts puts it this way:

“Automated AR turns hours of work into seconds, making work easier and saving you labor costs.”

—Jason Rivera, VP of Sales

Besides reducing errors and the amount of manual tasks your AR department must perform, and saving you labor costs by streamlining processes and automating AR, the PayTrace digital B2B payments solution gets you paid faster, reducing Days Sales Outstanding (DSO), while simultaneously lowering your credit card fees. What are the potential savings? Working with Merchant Services, you’ll be able to quickly analyze your statement and see a dollar total of how interchange optimization can impact your bottom line.

Remember that B2B firms (like you!) are clamoring to digitize and automate B2B payments faster than ever to overcome the effects of the pandemic and keep up with the competition.

In transforming their accounting processes, these businesses are doing more than simply saving themselves and their clients time, effort, and money with an e-invoice system and accounts receivable automation software, they’re discovering further benefits, like:

In our next blog, we’ll explore how accounts receivable automation and e-invoicing improve customer experiences, deliver real-time insights into your payments process, increase visibility into customer payment status, history, and patterns, and accelerate cash flow and your access to capital to help you more accurately predict revenue and grow your business.

To learn how PayTrace accounts receivable solutions and e-invoicing solutions can help you automate processes and SAVE LOTS of time, money, and effort.

CEDP explained

Visa has announced its new Commercial Enhanced Data Program, which aims to improve the overall quality of...

We are excited to announce the release of a new version of the PayTrace API: Version 3 (V3)....

PayTrace is excited to announce our partnership with Price Reporter, the experts in GSA consulting. This strategic partnership...