With so many payment options out there today, offering the right payment types for your business and customers depends on several things: your business size and model, what you sell, your average ticket price, and more.

But while there’s no exact answer to what you should be offering, there’s one payment type that nearly every business, especially B2B organizations, should take advantage of: ACH payments.

What is ACH?

ACH, or Automated Clearing House, is a secure electronic network that facilitates electronic bank payments. Simply put, it's one of the most common ways to move money between bank accounts.

B2B payments and ACH

For B2B organizations, ACH payments come with a couple of particularly noteworthy benefits.

- Streamlined Processes

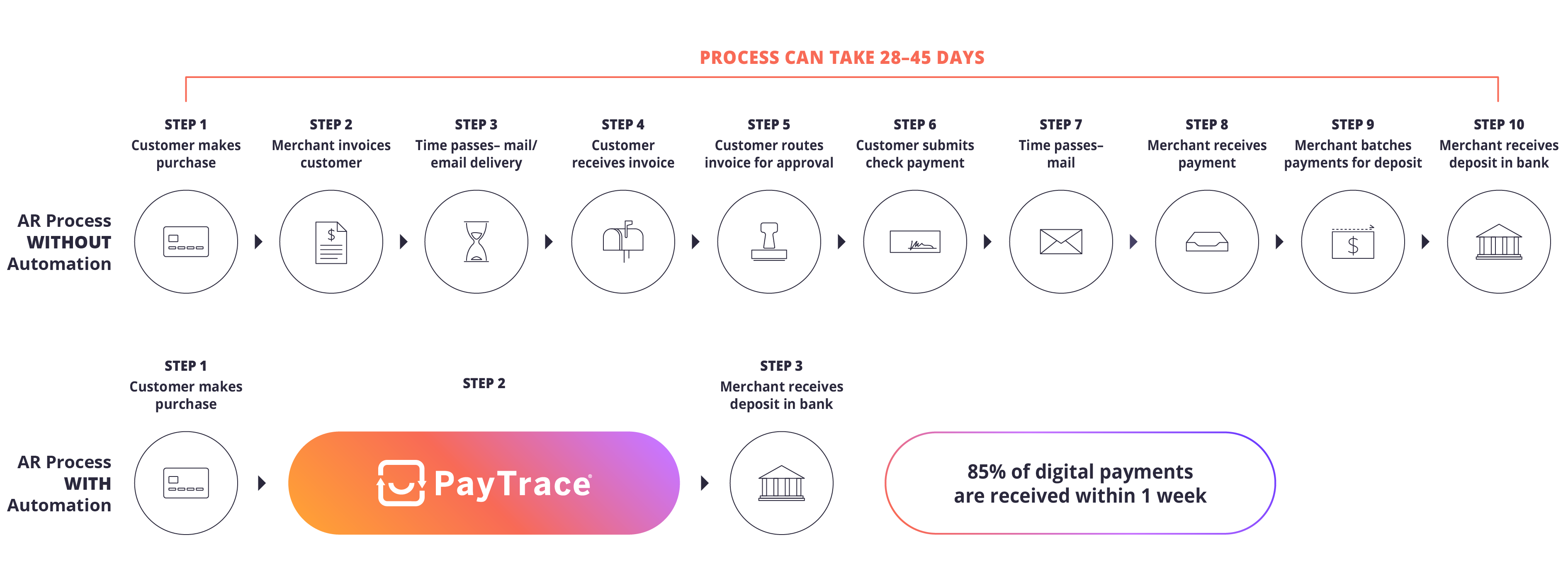

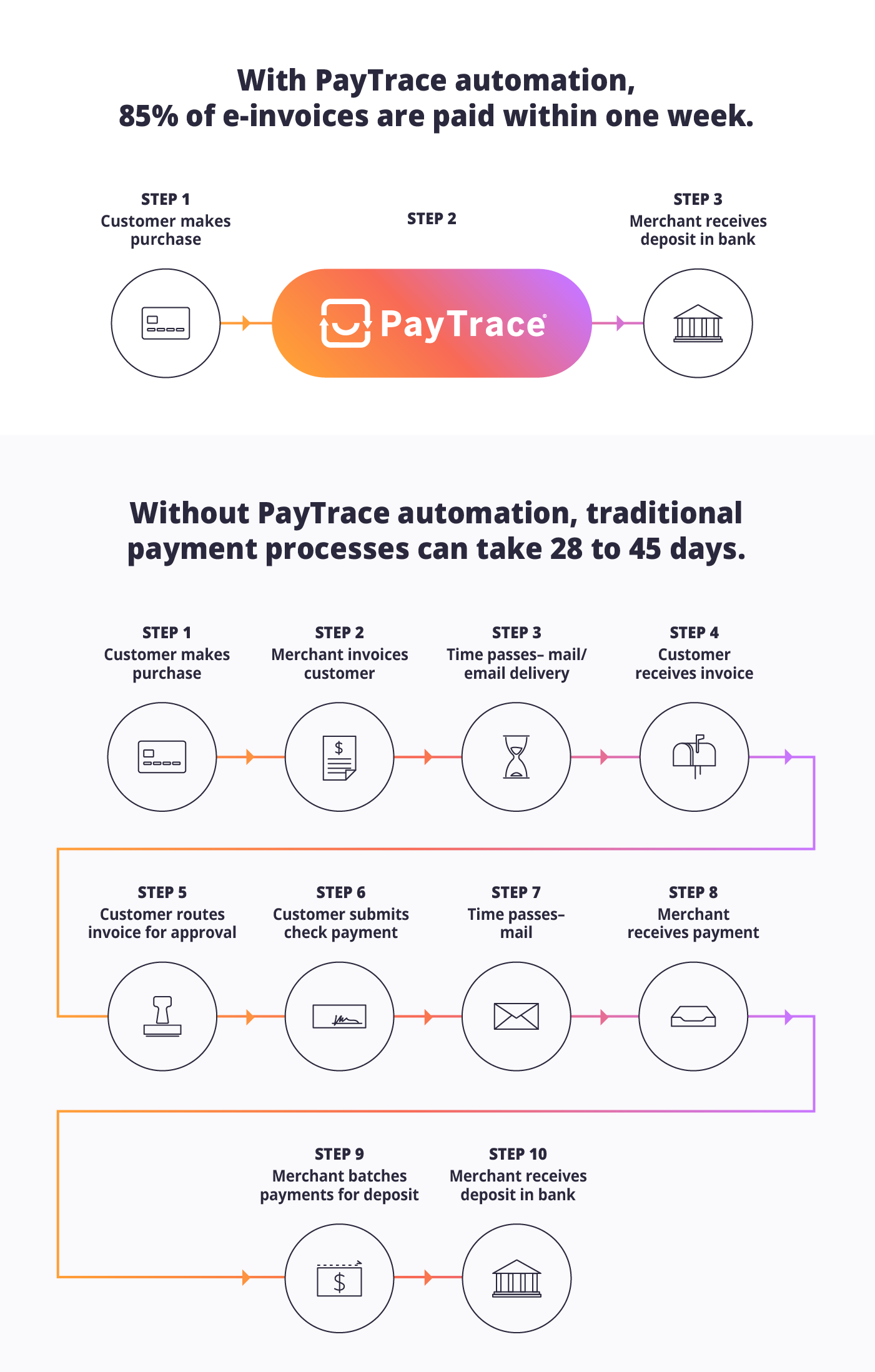

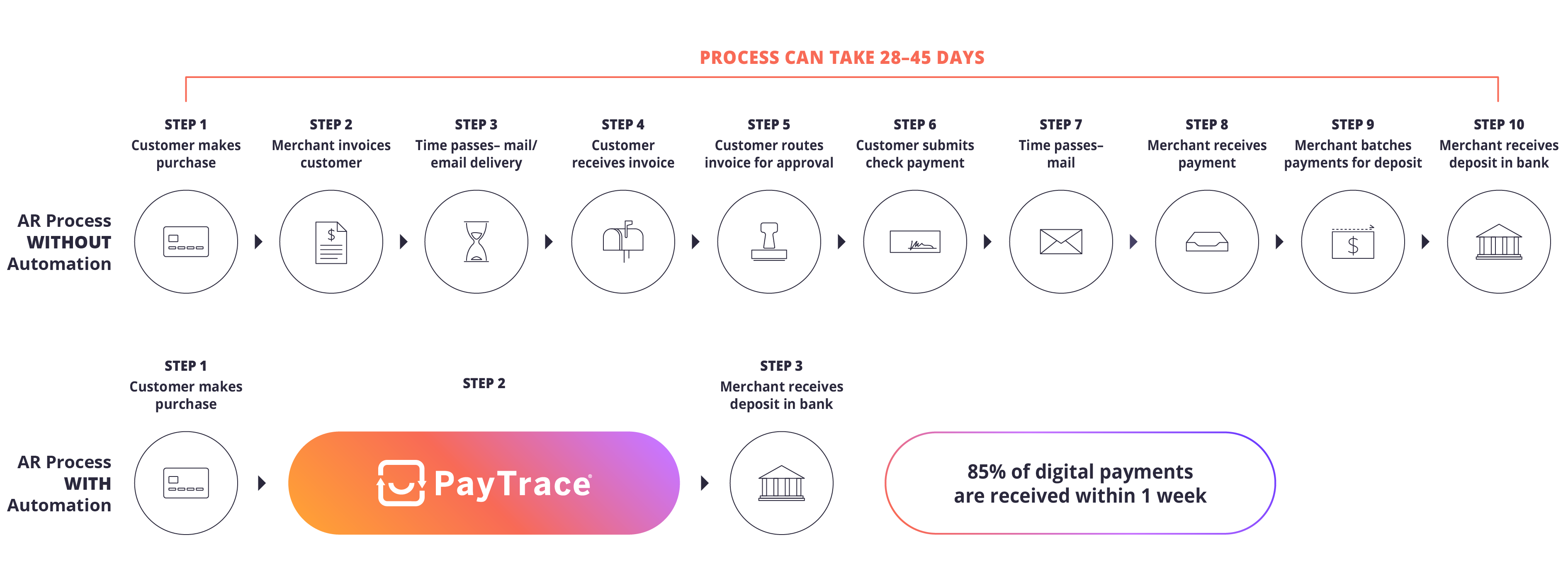

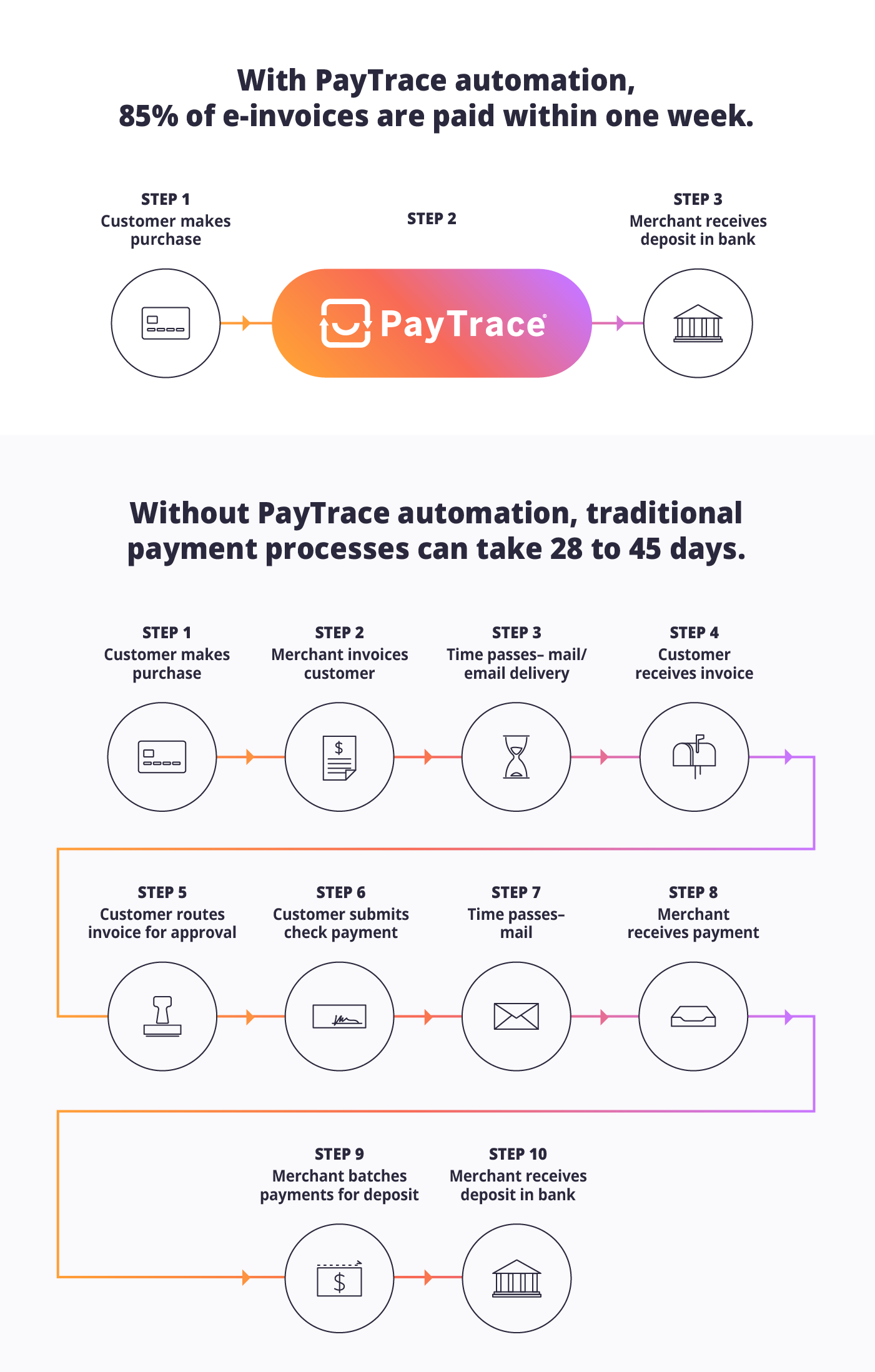

B2B transactions often involve large totals and many separate transactions. ACH payments help streamline these processes, allowing for quicker and more efficient fund transfers between businesses. - Improved Cash Flow

Waiting for checks to clear is an unnecessary headache for B2B companies. ACH payments accelerate cash flow by reducing overall processing times. On average, ACH transactions can be processed within 1 to 3 business days. Compared to the 30 - 45 days that processing traditional checks can take, ACH provides a faster alternative and ensures businesses have access to funds when they need them.

More reasons to accept ACH payments

All merchants, regardless of business model, can benefit from ACH payments. Let’s look at the other benefits that merchants enjoy, followed by the benefits their customers receive as well.

Merchant Benefits

- Cost Effective

ACH payment fees are often lower than traditional payment methods. According to industry info, on average, ACH transaction fees can be up to 80% lower, making them an attractive option for businesses looking to save some money. - Reduced Fraud Risk

Fraud is a constant in today’s economy, and ACH transactions are less susceptible to fraudulent activities when compared to other payment methods. Accepting ACH payments helps provide additional security to your business. - Easy Recurring Payments

For businesses that offer subscription services or regular billing cycles, ACH payments can help reduce the hassle of manual invoicing and ensure faster time to cash when compared to manual check payments. - Less Chargeback Risk

Chargebacks are a hassle, there’s no question. ACH payments, however, generally have lower chargeback rates compared to credit card transactions, meaning your business can enjoy more secure transactions and avoid any lost revenue that comes with chargebacks. - Flexible Payment Options

Accepting ACH payments gives your customers more flexibility. Some customers prefer the convenience and security of ACH transactions, and by offering this payment option, you can attract and retain a diverse range of customers.

Customer Benefits

- Enhanced Security

Just as merchants enjoy less fraud risk, your customers do, too. The authentication and encryption measures in place make ACH transactions less susceptible to fraud, providing customers with peace of mind knowing that their financial information is secure. - Cost Savings

For customers, ACH payments often come with a cash discount. This means more money in their pockets, making ACH an attractive option for anyone looking to save money. - Convenience and Automation

Paying by ACH is convenient for customers. Once set up, they can automate recurring payments, such as monthly bills or subscription services, eliminating the need to remember due dates and reducing the risk of late fees.

Accept ACH payments today

The benefits of accepting ACH payments go beyond simple cost savings. Businesses of all kinds, especially B2B companies, can streamline operations, reduce risks, and access a broader customer base, while their customers enjoy enhanced security, cost savings, and convenience.

Are you ready to take your business to the next level? Consider adding ACH payments today – your bottom line will thank you!

CONTACT OUR B2B PAYMENT EXPERTS >